Optimize treasury relationships

Brink's will send your deposit credits to any U.S. Bank account of your choice. Rightsize your treasury relationships for your business.

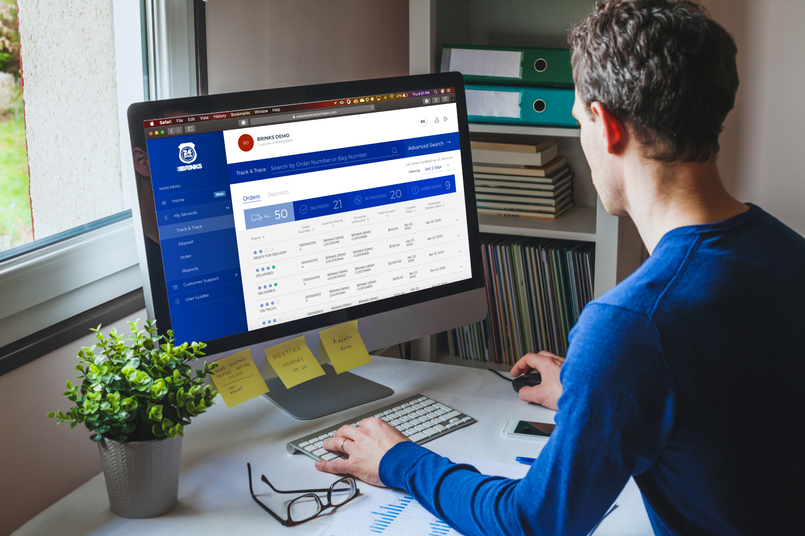

Access a new stream of working capital by getting credit for cash deposits within one business day.

Use your cash within one business day and rely less on interest‑based loans or lines of credit to manage your cash flow.

Brink's will send your deposit credits to any U.S. Bank account of your choice. Rightsize your treasury relationships for your business.

Eliminate in‑branch deposit fees and reduce your costs by having Brink's electronically credit your accounts instead.

Eliminate trips to the bank for daily bank deposits by getting faster access to your funds digitally.

Guarantees deposits in your bank next business day for seamless integration of your cash operations.

Dado que el efectivo sigue siendo un método de pago preferido por consumidores de todas las edades, la tecnología para el manejo de efectivo está en constante evolución hacia el futuro. Como resultado, tanto las tiendas minoristas como los bancos están siempre en busca de nuevos servicios y dispositivos para satisfacer las necesidades de sus clientes de manera más eficiente.

A pesar de la creciente popularidad de los pagos por dispositivo móvil, el efectivo sigue siendo muy utilizado por los consumidores de todo el país. Con esto, muchas personas siguen utilizando efectivo para pagar las tarifas gubernamentales, como impuestos, multas de aparcamiento, cargos judiciales y más. Este uso de efectivo crea una necesidad de gestionar efectivamente el ingreso de efectivo para permitir operaciones eficientes diariamente en los organismos gubernamentales.

Ya sea que trabaje para el gobierno local o federal, muy probablemente su organización acepte efectivo como forma de pago. Desde cobrar impuestos y tarifas de multas de aparcamiento hasta facturas de servicios públicos y más, las dependencias gubernamentales reciben una sorprendente cantidad de efectivo por año.